Blog

All Blog Posts

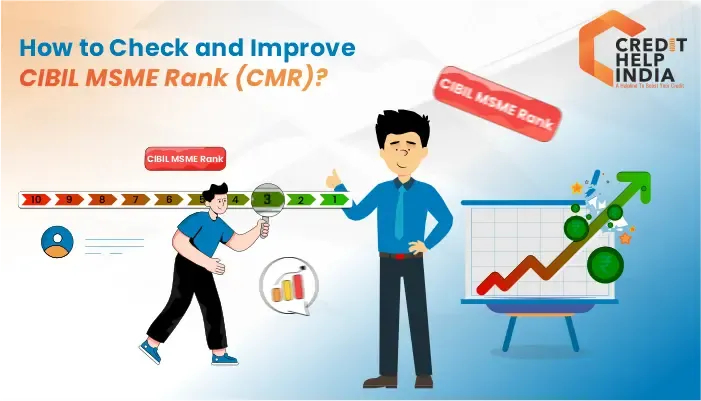

Think of your CIBIL MSME rank as your business's trust indicator in the financial marketplace.

February 18, 2026 Read More

|

For Indian businesses, loan approvals today are dependent less on projections and more on financial behaviour.

February 18, 2026 Read More

|

To improve CIBIL score after loan default, borrowers must first understand how defaults are recorded and how lenders interpret credit behaviour in India.

February 6, 2026 Read More

|

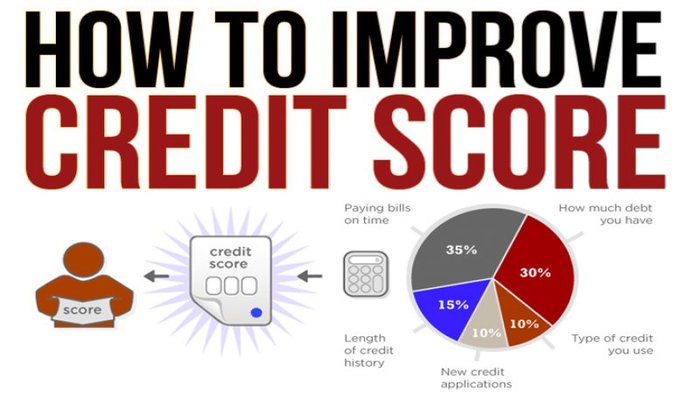

Missed payments and delays slowly drag your credit score down over time. That’s why learning how to increase the CIBIL score is the only correct action

January 20, 2026 Read More

|

Suddenly, you realise your credit card payment was due yesterday. Your heart sinks. Will this affect my CIBIL score? Can one missed payment really impact my financial future?

November 22, 2025 Read More

|

If you've ever applied for a loan, a credit card, or even applied for job in Banking,Finanace or IT Sector , you've probably heard someone mention your credit score.

November 22, 2025 Read More

|

Think of your CIBIL score like your financial reputation. Just as your reputation is built by your actions, your credit score is built by your financial habits.

November 21, 2025 Read More

|

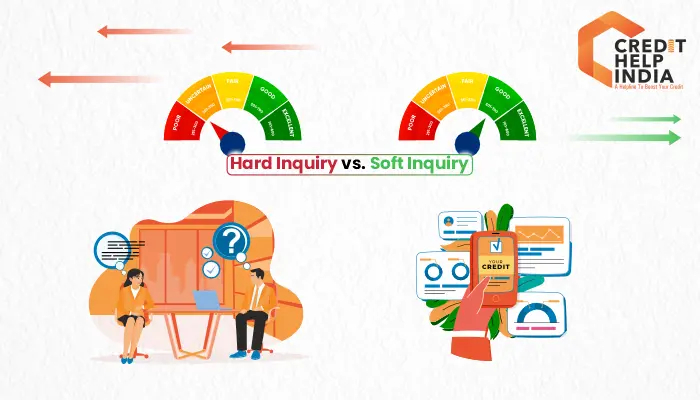

When you apply for a loan or credit card, lenders often run a credit check. But not all credit checks are the same.

November 21, 2025 Read More

|

India, even today, continues to struggle with widespread credit awareness gaps.

November 13, 2025 Read More

|

With home loan interest rates starting from 7.35% per annum across leading lenders in October 2025, thousands of families are stepping forward to secure their piece of property.

November 13, 2025 Read More

|

Think about this very simple question: How do lenders ever get an idea of who is trustworthy enough to lend money? It is simple they will just analyze their creditworthiness.

April 10, 2025 Read More

|

SMEs often depend on micro-loans, which are smaller-scale financial aids, to fuel their operations, expand their ventures, or navigate through challenging financial times.

April 9, 2025 Read More

|

Where a personal credit score gives insights into your trustworthiness as a borrower in a single number, on the other side when you are running your own business, you have a business credit score

April 9, 2025 Read More

|

The answer is yes! Individuals often need short-term financial solutions to address immediate concerns. Financial emergencies don't always wait for ideal CIBIL scores, which is why short-term loans are designed to offer a swift flow of funds to tackle une

July 2, 2024 Read More

|

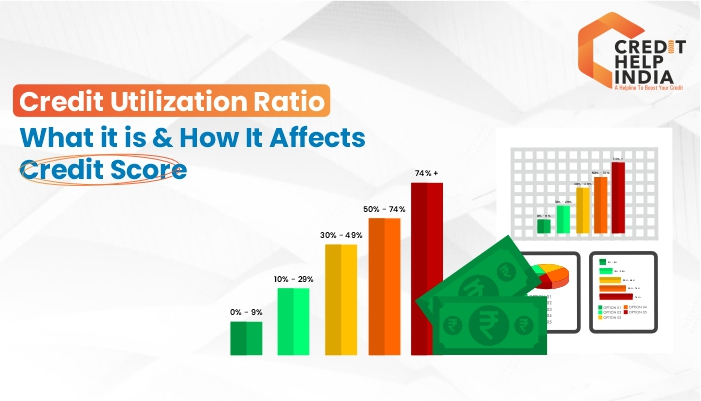

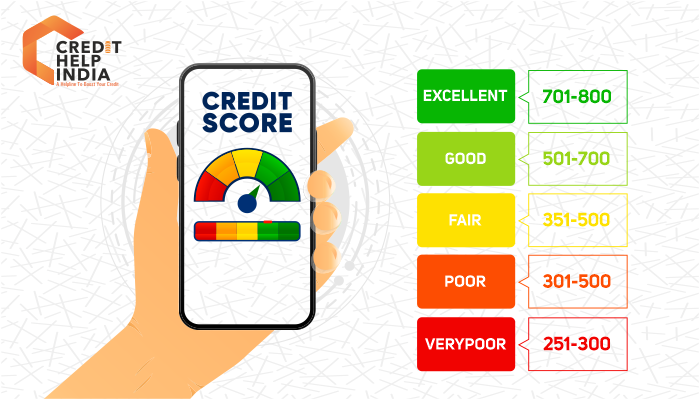

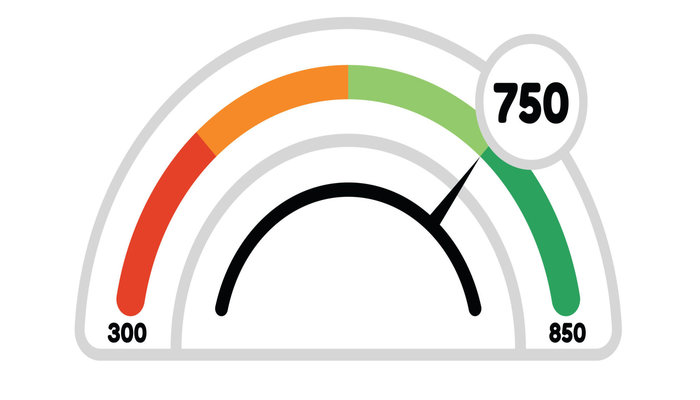

Credit score, a three-digit number that ranges between 300-900 has a lot to say about how responsibly you have managed your credits. Now, your financial behavior is being determined by your credit score.

July 2, 2024 Read More

|

Building a solid credit score is like creating a foundation for your financial future. It opens doors to better interest rates & easier loan approvals. But what if you don't have a credit card to kickstart your credit journey?

July 2, 2024 Read More

|

Settling an education loan, while it may provide temporary relief, can leave a lasting mark on your credit report and CIBIL score for a longer period of time.

February 7, 2024 Read More

|

Your healthy credit history is in your hands no matter what the condition states or perceives. Be it a medical emergency or any financial crisis that has taken place in your life all of a sudden,

February 7, 2024 Read More

|

That is because it strongly presents our credibility and that is the only way with which a good or bad financial stand can be proved, no matter if you are applying for a loan or a credit card, a healthy credit score is all it takes.

February 7, 2024 Read More

|

A loan settlement can promptly impact an individual's CIBIL score, a crucial factor in determining one's creditworthiness.

February 7, 2024 Read More

|

Read this blog and learn some smart financial practices to diligently manage your credit and get your healthy CIBIL score back slowly and gradually.

February 6, 2024 Read More

|

When it comes to applying for a loan, whether it’s for a home, car, education, or any other relevant expense, lenders typically rely on a set of factors to make their decisions.

February 5, 2024 Read More

|

A CIBIL score is very much important because it helps in the following ways

February 5, 2024 Read More

|

Businesses are always in need of funds to support day-to-day operations efficiently.

April 3, 2023 Read More

|

Recently the banks have the RBI increased the repo rate. This has directly impacted the interest rate charged by the bank.

April 3, 2023 Read More

|

As we enter the new year, many are thinking about ways to improve our financial health. One important factor to consider

January 19, 2023 Read More

|

When it comes to borrowing habits, it's easy to fall into the trap of making broad generalisations about men and women. However, the truth is that both genders have their own unique approaches

January 19, 2023 Read More

|

If you’re like most credit card users, then you should know about the new rules RBI has put in place

December 7, 2022 Read More

|

The festival of lights, Diwali is just to bang on your doors. And with this coming, your home lightens up with attractive and vibrant lights and delicious foods.

October 20, 2022 Read More

|

Diwali is the most prestigious festival that we celebrate every year. This festival is not just a festival of lights but a start of the fresh Hindu financial year.

October 20, 2022 Read More

|

A loan settlement present on your CIBIL credit report can take a toll on the overall credit score and also will reduce your chances of getting good offers on future loans.

September 29, 2022 Read More

|

A good CIBIL score plays a major role in determining how fast you can get the financing and the interest rate of the same.

September 29, 2022 Read More

|

You can certainly apply for a credit or loan, but you must know when the right time to apply for the credit or loan. The lenders assess various aspects before approving the loan, and so you must be aware of your credit score.

January 13, 2022 Read More

|

A good credit score in today's era when the economy is highly credit based or credit driven has become very important for anyone's financial success.

May 8, 2019 Read More

|

Credit repair is a process of fixing or rectifying your credit score, whether it could be in any shape or forms.

May 7, 2019 Read More

|

Once your CIBIL score is calculated, it is sent to banks for determining on what interest rate, the loan should be sanctioned to you.

April 3, 2019 Read More

|

|

Credit rating is an opinion which is formed by the rating agencies who ascertain the future ability and the obligation of an individual to meet its debt obligation when they arise.

April 3, 2019 Read More

|

CIBIL score act as a guide to the financial institutions which help to verify them the creditworthiness of the individual before granting for a loan.

March 22, 2019 Read More

|

Company Credit Report (CCR) is a comprehensive and detailed record of a company or a firm which gives insights into the credit health of a company.

March 22, 2019 Read More

|

A good credit score has become essential to one’s financial success as a good CIBIL score throws light on the creditworthiness of a borrower.

March 5, 2019 Read More

|

It is very essential to have a good credit rating of an individual. Without the credit card also an individual can make a good credit score.

February 25, 2019 Read More

|

The cibil score improvement agency is a solution provider to repair your credit score and get a loan immediately.

February 25, 2019 Read More

|

If the person has good credit score then the loan will been given with minimum interest.

February 25, 2019 Read More

|

Credit cards not just allowing the customer to borrow of money against the credit line, but also make them use of offers. Using these offers carefully will maintain a good credit score or how to improve cibil credit score.

February 25, 2019 Read More

|

Opting for a personal loan or not is all on you, but you should know these points when to apply for a personal loan.

February 22, 2019 Read More

|

To have the best cibil score for loan would mean that the person having them is worth loans.

January 23, 2019 Read More

|

A credit report is a comprehensive summary that describes your credit history.

January 23, 2019 Read More

|

If you are thinking of, how to increase cibil score instantly and that hiring professionals mean it will be done faster, then you are entirely wrong as even the professionals need the basic time to make things better.

January 23, 2019 Read More

|

Your Cibil loan is based on your CIBIL report, which is a summary of your credit history.

January 23, 2019 Read More

|

Credit scores play an important role for the banks in making a decision while providing credit facilities to you.

January 23, 2019 Read More

|

Read on to learn the importance of the CIBIL score when making use of a personal loan.

January 23, 2019 Read More

|

Most people wondering how to improve cibil score have issues with their CIBIL report but don’t know what to do about it.

January 23, 2019 Read More

|

A Good score helps in building credit health and boost your future financial dealings. Now the real deal is how to increase credit score?

January 23, 2019 Read More

|

Here we’ll look into the fundamental aspects of a credit score such as definition, ranges and their connotations and ways to improve credit score.

January 23, 2019 Read More

|

If you tend to keep a low credit score, then take help of cibil score improvement agency to improve your credit score.

January 23, 2019 Read More

|

Some points that you need to know to understand your credit worthiness while applying for a cibil loan.

January 22, 2019 Read More

|

Do heavy financial terms baffle you? Worry not! We have come to your rescue. We will begin by telling you about CIBIL score, how to calculate CIBIL score and how to increase CIBIL score.

January 22, 2019 Read More

|

It is important to a keep a regular check on your report which helps to maintain a healthy CIBIL score for loan.

January 22, 2019 Read More

|

If you as a borrower are eager to know about how to improve your credit score make certain that you unquestionably avoid a loan settlement.

January 22, 2019 Read More

|

So you have the best CIBIL score for loan and you go ahead to apply for the same. But alas! It gets rejected. Shocked? Well, don’t be.

January 22, 2019 Read More

|

If you are confused about CIBIL score and ways to improve your bad credit report, you can get assistance from a CIBIL score improvement agency with good experience of working in the credit industry.

January 22, 2019 Read More

|

To have the best cibil score for loan means that you have more chances of getting your cibil loan approved.

January 22, 2019 Read More

|

When applying for a loan, you might have planned out your repayment for a certain period. But it will affect your CIBIL score for loan in the long term.

January 22, 2019 Read More

|

If you are not aware of your credit score or have a bad one, it is time to work to improve it. As good credit score will help to get cibil loan easily without doing lots of affords.

January 22, 2019 Read More

|

If your credit score is unsatisfactory, it might result in your loan application getting rejected. Thus, it is important to know how to improve CIBIL score immediately.

January 22, 2019 Read More

|

Found discrepancies in your credit report? Worried about how to improve cibil score? You are not alone! There are numerous individuals who have encountered this issue but got it resolved with a few simple steps.

January 22, 2019 Read More

|

We seek to spread awareness about the myths and impart knowledge on how to improve your credit score.

January 22, 2019 Read More

|

Do you know that there are bad credit practices you might be following unknowingly, and they are the reason you don’t have a good credit score? Sitting on these habits will not improve credit score.

January 22, 2019 Read More

|

Do you want to know how can I improve my cibil score then take help of expert.

January 22, 2019 Read More

|

Defaulting your educational loans can have a huge impact on your cibil score. You can’t your dreams on hold due to the fear of poor credit scores. Well, this is where the professionals come!

January 19, 2019 Read More

|

Enjoying a decent credit score doesn’t imply that you’ve countless pots of money. It all has to do with settling on the correct choices with what you already have. To make the right decisions, you need to pick up the tricks of the credit scoring game.

January 18, 2019 Read More

|

While going through CIBIL Report then you must have come across the term “Enquiry Information section” if you’re not familiar with Loan Application inquiries then it’s critical to understand.

October 23, 2018 Read More

|