The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Free Credit Score

Thinking How to Get a Free Credit Report online? Everything you should know.

If you want to know more about your financial situation, you should get a free Credit Report online. Your Credit Score will determine whether or not you can receive loans, credit cards, or other forms of credit. It will also affect the interest rates and terms of those loans. Below you will find some tips for obtaining your free Report. These will help you in knowing your credit health and Credit Score. Although it is not necessary to check your Credit Score, it is still best to do so regularly.

What Information does Credit Report contain?

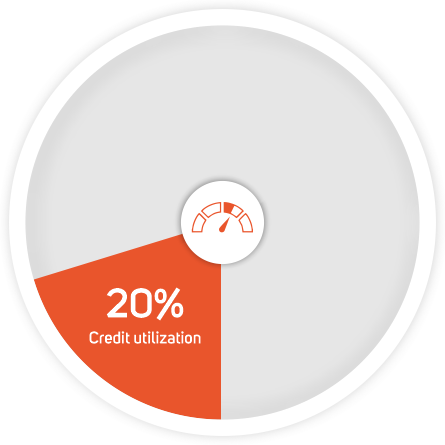

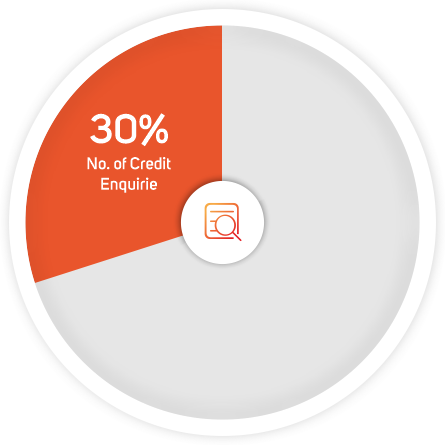

A free credit Report will contain detailed information about your finances. Usually, your report will include the payment credit history for your past and current accounts. It will also contain the credit limit that you have used. Some of the information in your report may not be accurate or up to date. Fortunately, you can obtain a free copy of your credit Report through Credit Help India. It's important to read your reports closely to ensure that all of the information is correct.

Do my Credit Report shows my actual Credit Score?

First, you should be aware of what your Credit Report contains. Your report does not show just your Credit Score. It also tells you about your credit history and credit health. It includes all of your payments and account balances for all types of loans. If you have a poor Score, you will notice accounts that have past-due payments and accounts that have been reported to collections on account of default. You can use your free Credit Report to improve your Credit Score.

If you are looking for solutions to improve your credit Score don't wait join us we provide the best solutions to all your problems and guarantee increase in your Credit Score.