Credit Utilization Ratio: What it is & How It Affects Credit Score

Introduction

India, even today, continues to struggle with widespread credit awareness gaps.

The credit utilization ratio remains one of the most misunderstood yet important aspects of credit management amongst Indian borrowers.

This single metric, which measures how much of your available credit you are actually using, silently influences nearly 30% of your credit score calculation. Yet, most Indians discover its importance only after their loan applications get rejected or credit card limits are slashed.

Understanding your credit utilization is about recognising how lenders perceive your financial behaviour. Mastering this ratio becomes your gateway to better interest rates, higher credit limits, and genuine financial freedom that goes beyond just approvals from banks.

Key takeaways -

Your credit utilisation ratio influences 30% of your CIBIL score, second only to timely payment history.

Keep your utilisation below 30% to show lenders you use credit responsibly and aren’t financially stretched.

Report timing and credit limit changes can distort your ratio. Pay before the statement date and track limit updates.

Maintaining low, consistent usage across all cards builds stability and improves approval chances for major loans.

Zero utilisation isn’t ideal; use small, regular transactions to keep accounts active and credit behaviour visible.

What Is a Credit Utilization Rate?

Your credit utilization rate is essentially the percentage of your total available credit that you're currently using.

Think of it as the ratio between what you owe and what you could potentially borrow.

For example, if you have a credit card with a ₹1,00,000 limit and you have spent ₹30,000, your credit card utilization ratio sits at 30%.

But there's more to the credit utilization meaning. Credit bureaus like CIBIL, Experian, and Equifax calculate this metric in two distinct ways:

1. Per-card utilization: This examines each individual credit card separately. You might have three cards, one at 10% usage, another at 45%, and a third at 60%. Each tells its own story about your spending patterns.

2. Overall utilization: This looks at your total credit picture. If you have three cards with combined limits of ₹3,00,000 and you've used ₹90,000 across all of them, your overall utilization stands at 30%, regardless of how it's distributed.

The credit utilization definition also covers personal lines of credit, overdraft facilities, and even certain business credit instruments that contribute to this calculation.

Please note - However, term loans like home loans, car loans, or personal loans don't factor in if they follow a different credit assessment logic called the debt-to-income ratio.

How to Calculate Your Credit Utilization Ratio (And What Affects it)

Calculating your credit utilization ratio requires nothing more than basic division, but understanding what influences it demands a deeper look into your credit ecosystem.

What Actually Affects Your Ratio:

1. Purchases Made Just Before Your Statement Date

Even if you pay your card bill in full every month, the timing of your spending can make your utilisation look higher than it really is.

Here’s why:

- Credit card companies send your account snapshot to the credit bureau on your statement date, not your payment date.

- If you’ve made big purchases a few days before the statement is generated, your outstanding balance will appear large.

- So even if you clear it immediately after, the bureau will still record a temporarily high ratio for that month.

To avoid this, make mid-cycle payments or pay down your card before the statement cut-off.

2. Credit Limit Reductions by Banks

Your utilization ratio depends on two numbers: used credit and available limit.

If your bank reduces your credit limit even slightly, your utilization will jump automatically, even if your spending hasn’t changed.

For Example :

- Suppose your total credit limit was ₹1,00,000 and you had a balance of ₹20,000 (20 %).

- If your bank cuts the limit to ₹60,000, that same ₹20,000 now represents 33 % utilization.

Banks may lower limits due to inactivity, overall risk policies, or your own high spending patterns.

The trouble is, you often learn about it after the ratio spike shows in your credit report.

3. Having Several Cards with Low Limits

Many people in India hold multiple entry-level credit cards with small limits, assuming more cards mean a stronger profile.

But this can backfire.

Each low-limit card is easy to max out with even moderate daily use. For example, spending ₹8,000 on a card with a ₹10,000 limit already shows 80 % utilization. Even if the total of all cards is acceptable, bureaus also look at individual cards.

High utilization on one or two cards can hurt your score, even when your combined ratio is fine.

TIP - Consolidate usage(keep 1–2 cards) for regular spending, and keep others mostly idle with small, automated payments (like utility bills) to maintain activity but low utilisation.

What Is a Good Credit Utilization Rate?

Considerably, it is under 30% utilization overall.

It is because it has been observed that borrowers who maintain utilization under 30% demonstrate significantly lower default rates.

It signals to lenders that you're not credit-dependent, you have borrowing capacity, but aren't desperately tapping into every rupee available.

Your "good" utilization rate depends on several personal factors:

- If you're building credit from scratch, even 30% utilization with consistent on-time payments beats having no credit activity.

- If you're recovering from past credit damage, keeping utilization below 15% accelerates credit score improvement considerably.

- If you're preparing for a major loan application, dropping utilization to 5-10% for the three months before applying can yield measurably better interest rates.

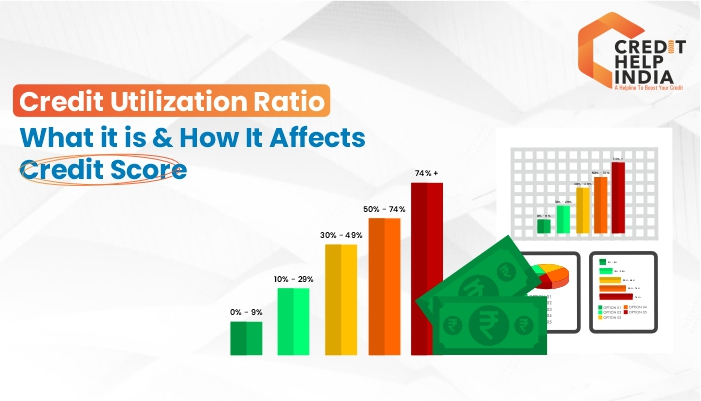

How Does Credit Utilization Ratio Affect Your Credit Scores?

Your credit utilization ratio carries approximately 30% weightage in CIBIL(credit) score calculations, second only to payment history at 35%.

High utilization (above 50%) signals financial stress.

When you're consistently using more than half your available credit, it is shown as potential overextension.

It suggests you might be relying on credit to meet basic expenses as well. This perception triggers score penalties that can drop your rating by a few points compared to maintaining 30% utilization with an identical payment history.

Medium utilization (30-50%) sits in a neutral environment.

You won't see dramatic score damage, but you're not optimising either, making it difficult to break into the "excellent" credit category even with perfect payment records.

Low utilization (10-30%) demonstrates healthy credit management.

This range tells lenders you have access to credit but aren't dependent on it. Your score benefits from this perception, potentially adding a few points compared to higher utilization brackets.

Very low utilization (1-10%) maximises score potential.

This is where the highest credit scores cluster. The algorithm interprets this pattern as both financial stability and credit balance; you maintain active accounts without relying heavily on borrowed funds.

How to Maintain a Healthy Credit Utilization Ratio

1. Pay Before the Statement Closes:

This is the single most effective technique for managing reported balances.

Your bank reports your balance to credit bureaus when your statement is generated, not when you pay your bill.

2. Make Multiple Payments Throughout the Month:

Rather than accumulating charges and paying once, consider weekly or bi-weekly payments that mirror your income cycle.

If you're salaried, pay down your credit card balance shortly after receiving your salary. If you're self-employed, align payments with your cash flow patterns.

3. Request Credit Limit Increases:

A higher limit with the same spending automatically improves your utilization. Most banks review accounts for limit increases every 6-12 months. You can proactively request increases by:

- Demonstrating increased income through updated salary slips or ITR documents

- Maintaining a perfect payment history for at least six months

- Showing regular usage (not zero activity, but not maxing out either)

4. Distribute Spending Across Multiple Cards:

If you have several cards, spreading expenses prevents any single card from showing high utilization.

- Rather than putting ₹40,000 on one card with a ₹50,000 limit (80% utilization), split it as ₹15,000, ₹15,000, and ₹10,000 across three cards with similar limits. Your per-card utilization stays much healthier.

5. Keep Old Cards Active:

Even if you have become capable of premium cards with better benefits, maintain your older cards with small, regular purchases.

These accounts contribute to your total available credit without costing you anything beyond perhaps minimal annual fees.

6. Set Up Balance Alerts:

Most banking apps allow you to set alerts when your balance crosses certain limit.

Configure alerts at 20% and 30% of your limit. When you hit 20%, start planning a payment. When you hit 30%, make it a priority to pay down before month-end.

7. Use Balance Transfer and EMI Conversions Strategically:

If you need to carry a balance temporarily, converting high-interest credit card debt to a lower-interest personal loan can improve your credit card utilization (since the loan pays off the card balance) while reducing interest costs.

However, evaluate whether the new loan's monthly obligation fits comfortably in your budget.

8. Monitor Your Credit Report Regularly:

Check your credit score free through Credit Help India or directly through CIBIL or Experian, or Equifax to check utilization early.

Sometimes, you might think you're at 25% utilization, but reporting discrepancies or forgotten subscriptions push it to 35%. Regular monitoring (monthly is ideal) helps you catch and correct these issues promptly.

Is it Good to Have Zero Credit Utilization?

A ratio of zero means you are not using any credit (i.e. you carry no balance). Is that ideal? Not always.

Why Zero Utilization Isn't Ideal?

- Credit scores are not just about avoiding risk, but are about demonstrating you can manage credit responsibly, and zero utilization suggests one of three scenarios to lenders:

- You're not using credit at all. If your cards sit idle for months, lenders can't assess how you handle credit in practice. You might have perfect potential discipline, but there's no evidence of actual behaviour.

- You might be using other credit sources not visible in the bureau data. Perhaps you're borrowing from informal sources, using digital lending apps, or relying on personal loans from friends and family. This introduces uncertainty, which lenders dislike.

- Your accounts might become inactive. Banks often close credit cards that show no usage for extended periods (typically 12-24 months). When these accounts close, you lose that available credit, which could spike utilization on remaining accounts if you ever need to use them.

FAQs:

1. What is the credit utilization ratio in simple words?

It is the percentage of your total available credit that you're currently using. For instance, if your credit limit is ₹1,00,000 and you've spent ₹20,000, your utilisation is 20%. A lower ratio (ideally under 30%) shows responsible credit use to lenders.

2. How does the credit utilization ratio affect the credit score?

This ratio is a major factor in determining your credit score (CIBIL score). A high utilisation (over 30%) suggests heavy reliance on credit and can negatively impact your credit score.

3. How to calculate your credit utilisation ratio?

To calculate your overall ratio, divide your total outstanding credit card balances by your total credit limits across all your cards, and multiply the result by 100. For example, (Total Balance/Total Limit)×100.

4. Should I apply for another credit card if my utilisation is high?

While a new card increases your total available credit, which can lower the ratio, it also leads to a hard inquiry that can temporarily drop your score. It's better to first focus on paying down your existing debt.

5. Does having multiple credit cards affect your credit score?

Not necessarily, as long as you manage them well. Multiple cards can increase your total credit limit, potentially lowering your overall utilisation ratio. However, you must ensure timely payments on all cards to avoid negative impacts.

Conclusion

Your credit utilization ratio is one of the fastest and the easiest ways to improve your credit score.

Keeping it below 30%, ideally under 10%, can mean the difference between loan rejections and approvals, between paying 12% interest and 9% on your home loan. That's lakhs saved over time, simply by managing how much of your available credit you actually use.

At Credit Help India, we have helped thousands of Indians change their credit profiles through smarter utilization management. Whether you're preparing for a major loan application or recovering from past credit challenges, understanding where you stand is the first step.

So, get a detailed analysis of your utilization across all accounts and personalised guidance from our credit experts today.