CCR (Commercial Credit Report) is a record of companies' past repayment of loans and credit facilities. Information on loan repayment is pulled from the Banks and lenders from where a company has taken loans. CCR is a tool Banks and lenders to determine your creditworthiness and future risk of repayment default.

Company Credit Credit Report is a record of your credit payment history. This information is pulled from various credit institutions. CCR is used by prospective lenders (banks and other financial institutions) to determine your credit behavior.

Commercial Report

Get Commercial Credit Information Report

for Your Business & Assess Your

Company's Credit Rank

A Good Credit MSME Rank is a key step to better business loan

Commercial Credit Report & Credit Rank

Commercial Credit Report is a report card of MSMEs of credit history and credit behavior while CMR (Credit MSMS Rating) is rank between 1-10 where rating 1 is the best and 10 is the. Worst. Commercial Credit Report( CCR) is prepared by Transunion. Commercial Credit Report is highly usable and actionable which provides a detailed insight into a business entity to whom Bank is lending.

List of topics covered:

- What Is Commercial Credit Report

- Credit Score vs Credit Rank

- How To Read Commercial Credit Report

- Importance Of Commercial Credit Report

- List Of Documents Required For Commercial Credit Report

- Factors Affecting Commercial Credit Report

- FAQs

What is Commercial Credit Report and Credit Rank?

Commercial Credit Report

Much as a Credit score refers to an individual's lending value, a trade report by Credit underlines a company's lending worth. The commercial Credit report is therefore a systematic declaration reflecting an organization's financial health in terms of information obtained from banks and financial institutions. This detailed report is further used for assessing a company's creditworthiness when a commercial loan is needed.

The following information is included in a commercial Credit report:

- Company background: Include background information on the company, such as the legal establishment, branches, ownership, and operating years.

- Financial information: Financial data that decide the company's credit standards.

- Financial history: Finance info, including payments, collections, income production, and more relevant to the financial history of the company. Besides these, the Credit rank is also essential. A rank of Credit resembles a score of Credit. It numerically summarises the company's CCR. Just like the score of Credit is between 300 and 900, a CCR ranges from 1 to 10, where 1 is the best possible. Only businesses with Rs.10 lakh credit exposure to Rs.10 crore are granted this designation. When you get closer to 1 the higher your chances are for a business loan to be secured.

Credit Rank

Credit Rank is equivalent to the Credit score given to individuals, provided to commercial organizations. It sums up the complete Company Credit Report (CCR) on a scale of 1 to 10 in one digit. Basically, the credit rank shows the chance of default payments. Therefore lower the ranking, the more likely a loan is. Therefore, 1 is the highest possible ranking. It should be remembered, however, that a credit rank is not allocated to all firms. The credit rank is applicable to only companies with loan exposure of 10 lakh to 50 crores.

Credit Score vs Credit Rank

Companies also apply for loans to run and expand their business and as the process of loan approval Banks and lenders generate Business Credit Reports from Transunion and other Credit Bureus to check the creditworthiness of a borrower.

Below is the comparison and difference individual Credit Score and Credit Rank to have a better understanding of both. Individual Credit Score Three-digit figure between 300 and 900 Credit Score more or equal to 750- Great Chances of loan approval Summary of past and present loan track record For Companies and Firms Ranking ranges between 1 to 10 1 is the best and 10 is the worst rank Summary of track record of Company/ firm past and current loan

| Credit Score | Credit Rank |

|---|---|

| For Individuals | For Companies(Prop,Partnership,Pvt Ltd etc) |

| Three-digit figure between 300 and 900 | Ranking ranges between 1 to 10 |

| Credit Score more or equal to 750-, Great Chances of loan approval | Closer to 10 – higher the chances of loan approval |

| Summary of past and present loan track record | Summary of track record of Company/ firm past and current loan |

How to read Commercial Credit Report?

Commercial Credit Information Report contains detailed information about a business entity which may be Proprietorship, Partnership, LLP., Private Ltd, or a Public limited firm.

Following are the different sections covered in a Commercial Credit Report

Identification: It is present at the top and contains Report Order Number, which indicates the number of times your report has been accessed from Transunion's database.

Enquiry Information: This section specifies the name of the company, an identification code, and address.

-

Borrower Profile: It is further divided into 4 sub-sections:

Borrower Details: It includes company name, legal constitution, class of activity, etc.

Address and Contact Details: It includes the registered office address, phone number, etc.

Identification Details: It includes the company’s PAN, company registration number, etc.

Delinquencies Reported on the Borrower: It includes the payment status of the company and the guarantors.

Business Credit Score: This section displays your credit rank, which ranges on a scale of 1 to 10. The lower the rank, the better are the chances of getting a loan.

Enquiry Summary: This section displays the list of inquiries done by lenders in the recent past.

Derogatory Information: This section contains information regarding defaults, overdue and dishonored cheques.

Outstanding Balance Details: This section provides an overview of the company’s asset classification with respect to the credit facilities availed.

Location Details: This section mentions additional contact information of the company.

Related Parties Details: It gives information about the related individuals or entities.

Credit Facility Details – As Borrower: This section contains details of the credit facilities availed by the company. It contains credit facility details, payment status, and overdue details.

Credit Facility Details – As Guarantor: This section contains details about the credit facilities guaranteed by the company.

Suit Filed Details: It gives details of suits filed (if any) by any of the previous lenders for the company.

Credit Rating Summary: It contains the latest three credit ratings assigned to the company by an external accredited rating agency.

Enquiry Details (Last 24 Months): This section provides details regarding the inquiries made by lenders for your company’s credit application.

Importance of Business Credit Report

Business Health Report is a very important document when a company approaches Bank or lender for a loan or credit facility. This report shows the behaviour and financial discipline of lenders and proves the creditworthiness of a borrower. Credit Rank gives an idea about the riskiness of a borrower and helps the lender in taking the decision of approval or rejection of loan approval. Credit Rank close to 1 increases the chance of loan approval. A good ranking is a key and indicator that how likely the prospective borrower is to repay the loan on time and without default. To avoid the chances companies should check their Commercial Credit Report regularly or at least once a year

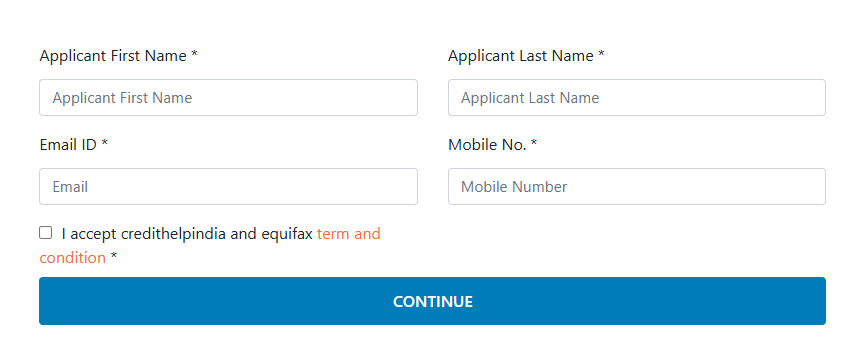

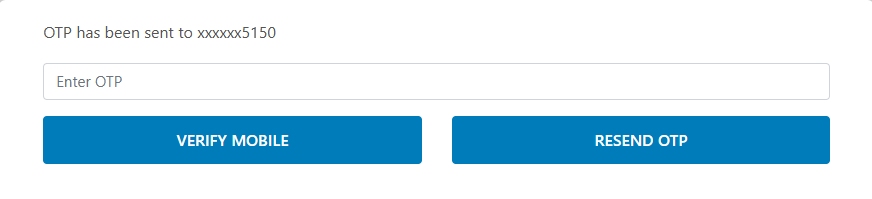

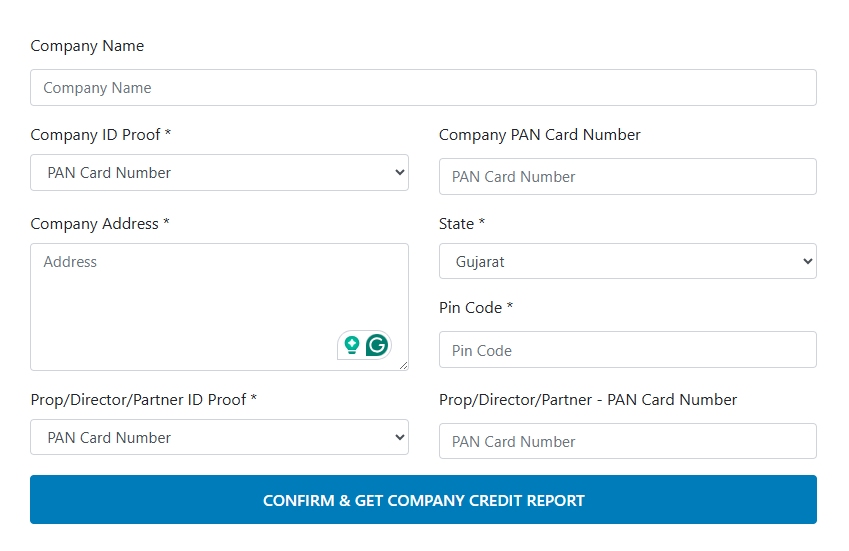

Documents Required to Check Commercial Credit Report

For Public and Private Limited Companies

Proof of Address (any 1): Electricity or telephone bill, bank account statement or passbook, registered lease/ sale agreement of office premises, address proof issued by commercial or multinational banks, registration certificate issued under Shops & Establishment Act.

A copy of board resolution along with authorized signatory list and specimen signature.

Company PAN.

Proof of Identity of one of the authorized signatories: PAN/ Passport/ Driving Licence.

( Any utility bill or telephone bill should not more than ninety days old )

-

For Partnerships

Proof of Address (any 1): Electricity or telephone bill, registered lease or sale agreement, bank account statement, etc.

Copy of partnership deed or certificate of registration.

List of authorised signatories with specimen signatures.

PAN of the partnership firm.

Proof of Identity of Partner requesting for the Company Credit Report: PAN, Driving Licence or Passport.

-

For Proprietorship

Proof of Address (any 1): Electricity bill, registration certificate issued under Shops & Establishment Act, etc.

Proof of Identity of the Proprietor: PAN, Passport, or Driving License.

NOTE: The above documents should be self-attested by the proprietor. Any utility bill or telephone bill should not more than ninety days old

Factors Affecting Commercial Credit Report

Following is the list of the major factors which are taken into consideration while preparing the Commercial Credit Report (CCR), and the Credit Rank:

Payment History: This refers to the financial discipline of the company while making repayment to the lender. Timely making loan repayment and interest servicing of overdraft/cash credit help in having a good Credit Rank.

Credit Utilization Ratio: This refers to the ratio of credit used by the company out of the total credit (loans and overdraft) available to the company A high credit utilization ratio shows the company as credit dependency on external funds to run the business hungry, instead of internal cash flow and thus negatively impacts the Company Credit Report and Credit Rank.

Length of Credit History: It refers to the duration over which the company has availed loans and repaid them. A longer credit history generally translates to a good Credit rank, provided the payments were made punctually.

Outstanding Debts: This refers to the sum of ongoing loans and other outstanding debts of the company which a company is supposed to repay. A large amount of such overdue or outstanding indicates lower repayment ability and highly leveraged company and lower the Credit Rank.

Vintage and Size of Company: Companies which are in their current business for a long period have better chances of loan approval since vintage companies are perceived as more creditworthy and have a high rate of loan approval also avail loans at a low rate of interest with easy terms and conditions. Stability and continuous growth help lenders in taking quick decision.

Turnover and Profit of Business: Turnover of a company tells about the size of the company and profit of the company shows that how efficiently and professionally a company is being run by its owners. High Turn Over and good Profit have a direct bearing on repaying capacity of a company. Generally higher ratio of profits and turnover facilitates a firm to avail loans to meet their credit requirement.

How can I Improve my Business Credit Score? The following are some key actions that can help you improve the Credit Rank as these get recorded in your commercial Credit report:

Always pay the loan EMIs and other outstanding dues on time to maintain a good repayment history.

Try to maintain a low credit utilization ratio to improve the company’s creditworthiness.

Sustain a long and good credit history to improve your company’s credibility.

Always maintain a feasible amount of outstanding debts, so that the company’s repayment ability is not affected.

Maintain a good balance between the company’s assets and available liabilities.