How to Check and Improve CIBIL MSME Rank (CMR)?

Introduction

Think of your CIBIL MSME rank as your business's trust indicator in the financial marketplace.

Derived from your credit history across the four bureaus, this rank (1-10) is what a lender reviews before any other factor. It answers their core question: "Is this business reliable with borrowed capital?"

A high rank builds credibility silently but powerfully. Therefore, knowing how to check CIBIL MSME rank online and improve it is fundamental to building solid trust with lenders.

Recommended Read - CIBIL MSME Rank: Meaning, Benefits & Impact on Business Loans

Key Takeaways

- Always aim for a CIBIL MSME rank between 1 and 4.

- Keep your credit utilisation ratio below 60%

- In high-risk sectors, even a 1-day delay (DPD) can affect your rank.

- Check CIBIL MSME Rank to see lender reporting errors before they cause a loan rejection.

- Only knowing your CIBIL MSME rank won't change it. To improve CIBIL MSME Rank, you need a plan to fix the underlying issues.

Get Commercial Credit Information Report for Your Business & Assess Your Company's Credit Rank

Factors That Influence a Business’s CIBIL Rank

1. Credit Repayment History (35% Weightage)

This factor is most effective. Every EMI, loan, or credit card payment made on time boosts your score. Even a single 30-day delay reported by a bank can cause a significant drop.

2. Credit Utilisation Ratio (30% Weightage)

How much of your sanctioned limit are you using? Consistently using over 75-80% of your overdraft or credit card limit signals financial stress. The RBI prefers businesses that use credit wisely.

3. Credit Type and Duration (15% Weightage)

A healthy mix of credit - a term loan for assets and a cash credit limit for working capital shows seasoned financial management. A longer, well-maintained credit history is always better.

4. Company Size & Industry Risk (10% Weightage)

Parameters like years in operation, ownership type, and industry segment are considered. Some sectors perceived as higher risk may need to demonstrate even stronger financial habits.

5. Recent Credit Applications (10% Weightage)

Making multiple loan inquiries within a short period makes lenders cautious. It implies urgency or possible rejections elsewhere.

6. External Factors

In India, certain sectors are naturally "high-risk" because they are cyclical or depend on government policy. So in that case, you can't change your industry, but you can change how you "stand out" within it. If you are in a high-risk sector, your financial discipline needs to be twice as good to maintain a CMR-1 or CMR-2.

Understanding these factors is the first step to strategically improve CIBIL MSME Rank.

How to Check Your CIBIL MSME Rank (CMR)

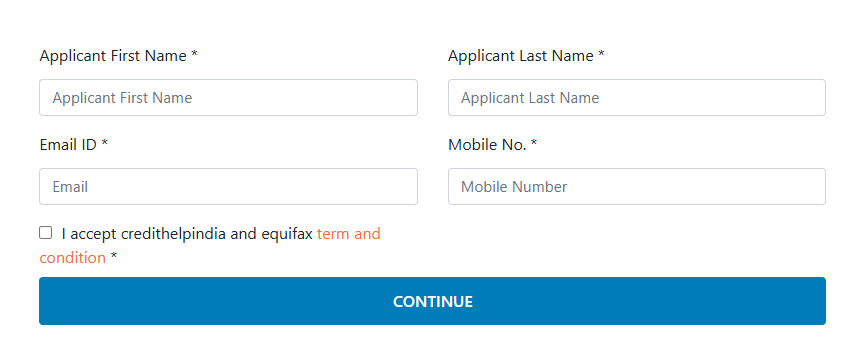

Step 1: Visit the Commercial Credit Report Page

Go to: https://credithelpindia.com/get-commercial-credit-report

To get your commercial credit report, begin by adding the details such as the applicant's first name, last name, email, and phone number.

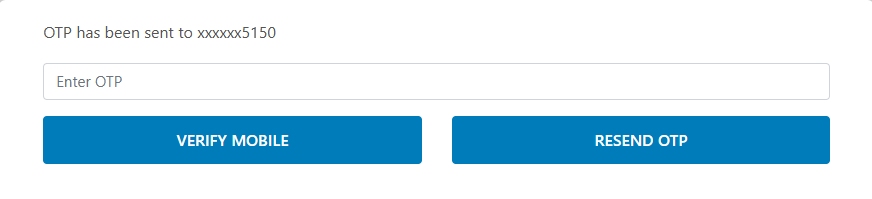

Step 2: OTP Verification

The process will then ask for an OTP sent to your phone number.

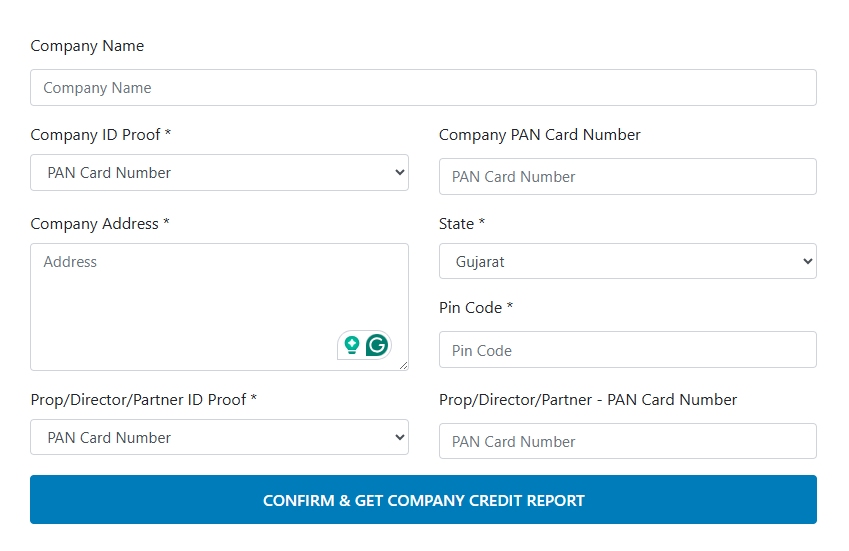

Step 3: Enter Your Business or Company Details

Once your OTP is verified, you will be redirected to the final information form. This step ensures that your report is fetched correctly from CIBIL’s system without any mismatch in company records.

Here you will need to add the following details:

- Company Name

- Company ID Proof

- Company Address

- Prop/Director/Partner ID Proof

- State

- Pincode

Final Step: Confirm & Get Your Company Credit Report with CIBIL MSME Rank mentioned.

How to Improve Your CIBIL MSME Rank or CMR Rating

Improving your CMR is a process that requires consistency and a clear understanding. While you can take several steps on your own, it’s important to recognise that these actions require careful strategy and professional guidance to deliver the best result!

1. Timely Repayment of Loans and Bills

Regular and on-time repayments are essential for improving your CIBIL MSME Rank.

But fairly, managing multiple repayment schedules can be difficult, especially when your business has various loans and bills to handle.

While you can track these payments on your own, working with experts can help ensure that every due date is met and that no payment is missed.

2. Review and Correct Your Credit Report

Credit reports can sometimes contain errors that negatively impact your CIBIL rank and correcting these discrepancies can be time-consuming and of course, not an easy task to perform.

While you can regularly check your report, it’s easy to overlook errors or misunderstand complex sections of the report.

Having an expert review your CIBIL MSME report ensures that inaccuracies are quickly noticed & corrected, keeping your credit profile accurate and reflecting your true financial health.

3. Lower Your Credit Utilisation

A high credit utilisation ratio can significantly lower your CIBIL MSME Rank, suggesting financial stress.

Paying off outstanding balances can help, but it requires a more strategic approach, particularly when it comes to managing debt and optimising your credit limits.

4. Avoid Excessive Loan Applications

Multiple loan applications within a short period can indicate financial instability, negatively affecting your score.

While it’s tempting to apply for credit when you need it, it’s crucial to apply only when necessary and with the right lenders.

But having an expert who can provide valuable advice on when and where to apply for credit ensures that each application aligns with your business needs and doesn’t harm your CIBIL MSME Rank.

5. Diversify Your Credit Portfolio

Maintaining a diverse credit portfolio shows lenders that your business can manage different forms of debt responsibly.

Again, finding the right balance is key. Taking on too much debt or not diversifying enough can have negative effects on your CIBIL MSME Rank.

Credit Help India Note - Get your current credit portfolio assessed and receive the best way to manage it, ensuring that you have the right mix of credit types that contribute positively to your score.

6. Maintain a Healthy Credit History

A long, healthy credit history is one of the most valuable factors in improving your CIBIL MSME Rank.

In the same context, managing your credit history requires careful attention, especially if you have multiple lines of credit.

An expert can help you decide which accounts to keep open, which ones to close, and how to maintain a healthy credit history.

Benefits of a High CIBIL MSME Rank

1. Easier Access to Financing

With a higher CIBIL MSME rank, lenders see your business as a lower-risk investment, which increases your chances of securing loans, credit lines, and other financial products

2. Better Interest Rates

A high CIBIL MSME rank often leads to more favourable interest rates on loans and credit. Lenders are more likely to offer competitive rates to businesses with a good credit profile, saving you significant amounts in interest over the life of a loan.

3. Improved Vendor and Supplier Relationships

A solid CIBIL MSME rank can improve your relationships with suppliers and vendors, who may offer better payment terms or credit limits to businesses with high CIBIL MSME ranks.

4. Higher Business Reputation

A high CIBIL MSME rank reflects financial discipline and reliability, which can increase your business’s reputation. This increased trustworthiness can attract potential partners, clients, and investors who are looking for financially stable businesses to work with.

5. Improved Negotiating Power

When your CIBIL MSME rank is strong, you are in a better position to negotiate favourable terms with banks, financial institutions, and other creditors.

6. Increased Business Growth Opportunities

With easier access to credit, better financial terms, and an improved reputation, your business is better positioned to take growth opportunities.

FAQs

1. How can I check my CIBIL MSME Rank online?

You can check your CIBIL MSME rank by visiting our commercial credit report page.

2. What is the fastest and most reliable way to improve CIBIL MSME rank?

The fastest and most reliable way to improve your CIBIL MSME rank is by making timely loan repayments and reducing credit utilisation below 30%.

Check and Improve Your CIBIL MSME Rank With Credit Help India

Take control of your business’s financial health by checking your CIBIL MSME rank today.

At Credit Help India, we provide expert solutions to improve your rank and help you access better funding opportunities. With our expertise and strategies, we guide you through the process, ensuring long-term credit stability for your business. Start now and change your business’s financial profile.