Understanding the credit score ranges chart in India

Introduction

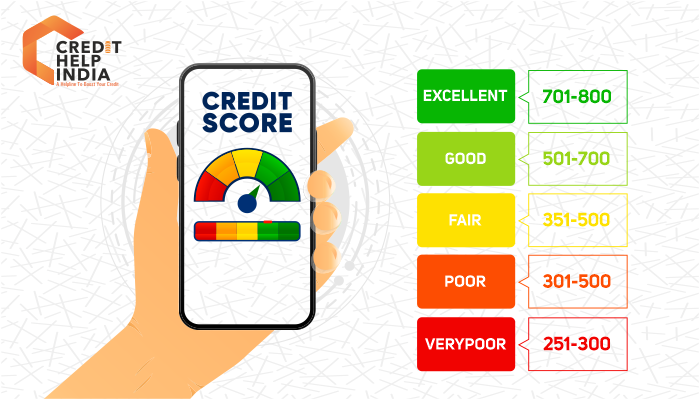

Credit score, a three-digit number that ranges between 300-900 has a lot to say about how responsibly you have managed your credits. Now, your financial behavior is being determined by your credit score. The reason? Your credit score is the first thing lenders will check to understand your eligibility for approving any financial condition in the future.

The CIBIL score range varies from 300 to 900, it is as simple as that, the closer you are to the score of 900, the better it will prove your creditworthiness and on the other side, it opens the door to get quick approvals for a loan or a credit card with the conditions that are in your favor. It is expected that the digital lending market will reach a value of around 350 billion dollars by 2023.

So, come let us understand more about the credit score ranges in India and how you can boost your CIBIL score and creditworthiness by following this blog!

Credit score ranges and their significance

In India, a chart of good credit scores ranges typically from 750 to 900. Here you will find the list of the various CIBIL score ranges and what they signify:

| Credit score range | Credit status | What it signifies |

|---|---|---|

| 300 - 660 | Poor Credit | You may find it critical to get approved for a lot many loans or credit cards. |

| 661 - 714 | Average credit | You will get multiple options when it comes to getting approved for any financial product, but you may not qualify for the best terms. |

| 715 - 777 | Good Credit | The chances of your application being denied will be very low, based properly on your credit scores, compared to having scores in the fair or poor range, and you're more likely to get a low interest rate and favorable terms. |

| 777 - 900 | Excellent Credit | You may qualify for the best financial products available, and you'll likely have multiple options when it comes to opting for repayment periods or other terms. |

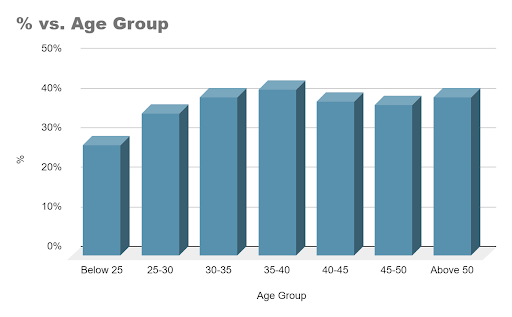

Credit score above 750 as per the age group

The given analysis shows that individuals below the age of 25 years are credit-healthy with only 28% with a strong credit score. The individuals aged 35 to 40 on the other side look the most credit fit. Whereas, 36% of individuals aged between 25 and 30 have a credit score of over 750.

It refines to 40% for consumers between 30 and 35, leveling at 42% for the age bracket of 35-40.

Source: Paisabazaar Making India Credit fit, May 2023

What are the best ways to improve your credit scores?

1. Clear all your existing debts

When you clear your debts, this states that you are laying a foundation for a strong financial future, understand that it is not always about how you can increase your credit score but more about how well you manage your finances.

Outstanding loans and credit card dues will unnecessarily drag your credit score to the level, where you have to face major consequences, so take a step forward in maintaining a healthy financial future by clearing your debts.

2. Make sure you pay timely payment of loans/credit card bills

The very first thing that comes into notice when it comes to building a credit score is to create a habit of making on-time payments.

Consistently paying your credit card bills and loan installments on time indicates your reliability as a borrower. Late payments not only attract penalties and higher interest rates but create a very bad impact on your credit score too.

3. Choose the period of tenure a little longer when acquiring a loan

Choosing a longer period of repayment means lower monthly EMIs where you can also manage your loan without missing payments. The tenure you choose can greatly impact your ability to manage your finances. While this may extend the overall duration of the loan, it can add a positive point to your credit history and help to improve your CIBIL score.

4. Go for new credit only when it is important

When you Google out how to improve your credit score you might have come across “apply for the new credit” right? Practically, it is suggested that not apply for new credit to just improve your credit mix. This will only hamper your credit score and not help you build your credit score, the way other methods do.

5. Limit the frequency of loan applications

When you apply for loans and credit cards frequently it will generate a negative impression in the minds of lenders. It may indicate financial instability for credit, both of which can negatively affect your credit score. So, do not apply for the loans if it is not necessary.

Conclusion

In conclusion, understanding the credit score ranges chart in India is very much important for your financial well-being. A credit score serves as a major indicator when it comes to examining creditworthiness, and influencing loan approvals and interest rates.

Getting the knowledge of the ranges – from poor to excellent – individuals can take clear and active steps to improve their scores. For personalized credit assistance in India, consider reaching out to "Credit Help India." With their expertise, they can guide you in enhancing your credit profile, ultimately opening doors to better financial opportunities.