We analyze your credit report.

We offer a comprehensive analysis of your credit report and credit profile to spot inaccuracies. Our credit experts will help you understand how to improve your credit profile and creditworthiness.

Featured On

In a city that never sleeps, managing your finances is crucial, where many individuals face a common hurdle – a compromised CIBIL score, Mumbai has been the center of demanding high living standards and high living always comes with good financial health, and good financial health is directly linked with? A good CIBIL score. So if your CIBIL Score is holding you back from enjoying the Mumbai lifestyle to the fullest, worry not. Consider relying on the services of a reputable CIBIL correction agency in Mumbai.

Navigate the streets of Mumbai with confidence, knowing that your financial health is in good hands.

We offer a comprehensive analysis of your credit report and credit profile to spot inaccuracies. Our credit experts will help you understand how to improve your credit profile and creditworthiness.

A dedicated credit expert works closely with you to fix all inaccuracies in your credit report. Credit expert also designs a personalized program to build your credit score and credit profile

Our team recommends the best personal loan and credit card suiting your credit profile. Your good credit profile helps you avail of loans at reduced EMI and lots of savings on loans.

Understanding your current credit situation is the first step we follow then we obtain copies.

Thoroughly review your credit reports to identify any inaccuracies or potential errors.

To navigate the complexities of credit repair, consider enlisting the expertise of a senior.

Collaborate with your assigned senior credit expert to formulate a strategic plan for addressing.

Why

Credit Help India?

Guaranteed Results

Years of Experience

Trusted by Clients

Businesses Transformed

Advice: Repairing your credit score quickly is an unrealistic expectation, despite the widely known fact that it's a gradual and time-consuming task. It needs to be understood that there are no magical solutions to instantly fix a damaged credit score, and individuals should be aware of misleading promises.

Depending on your very own financial situation, it can take anywhere from three months to 1 year to improve your credit score. Improving your credit score isn’t something you can achieve overnight, but don’t let that discourage you as we being your trusted cibil correction agency in Mumbai take responsibility for every damaged credit score that can be improved with a little commitment and patience.

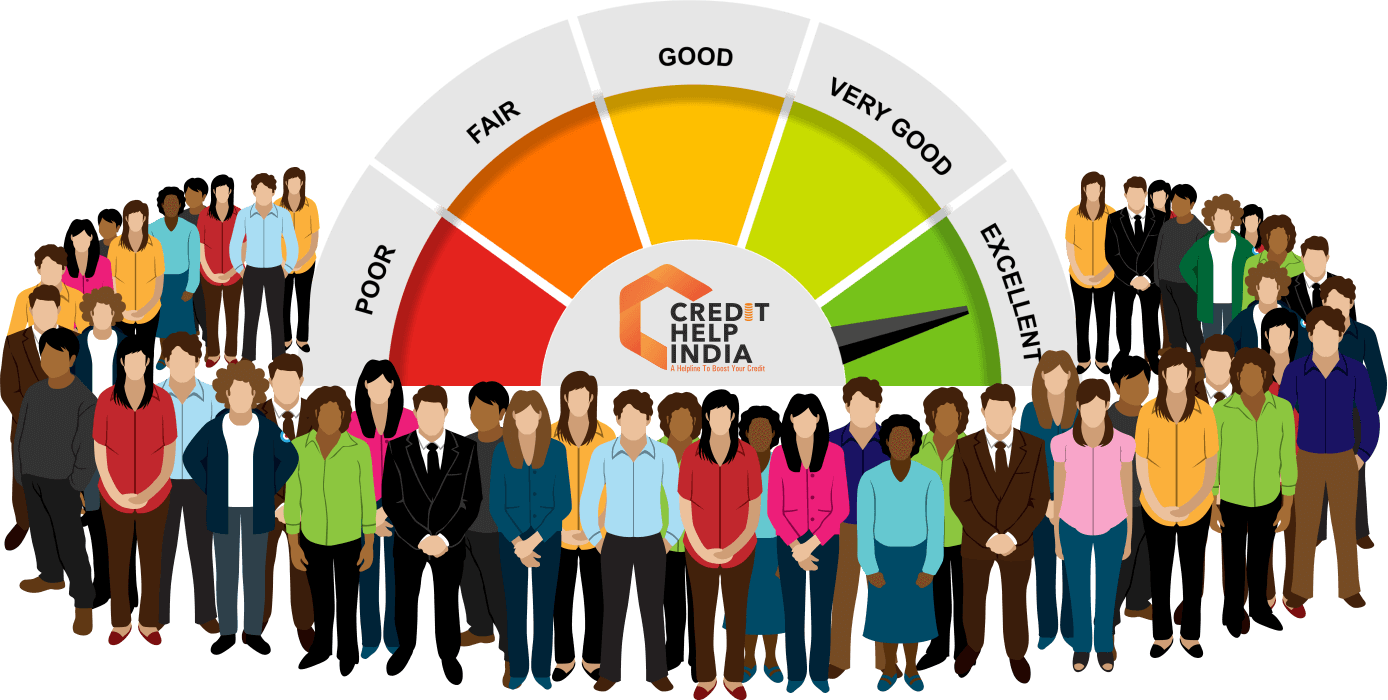

This indicates a growing awareness among people about the importance of maintaining a healthy credit profile. Credit Help India offers support and guidance to those facing challenges with their credit scores, helping them discover the complexities of credit management. As more and more Indians recognize the significance of a positive credit history, services like Credit Help India play a crucial role in empowering individuals to improve their financial well-being.

The increasing number of people seeking credit repair services suggests a positive trend toward responsible financial management and a desire to secure a better financial future!

The ideal credit score for a loan depends on the lender's criteria, as different lenders may have different requirements. Generally, a credit score of 750 or above is considered good.

Yes, you can improve your credit score by paying your bills on time, keeping your credit utilization low, maintaining a long credit history, and minimizing the number of credit applications you make.

In order to be eligible for loans, credit repair comes in with restoring your credit health. Individuals frequently need credit repair services to improve their credit scores and repair the harm that poor financial decisions in the past have done to their credit health.

Checking your credit score can give you an idea of your creditworthiness, and can help you identify areas where you may need to improve your credit. It can also help you detect errors or fraudulent activity on your credit report.

Your credit history provides lenders with information about your borrowing habits and money management. It shows reliability when it comes to debt and credit, as well as a decreased danger of situations like foreclosure & repossession.

Credit Help India help you improve your credit score.

Your Data Is Safe With Us.

Keeping your data safe and secure is a top priority for us and we are committed to it. We have implemented 256 bit Secure Encryption SSL to ensure data security and it is validated by Go Daddy Secure Certificate Authority.