Your Business needs Finance to grow

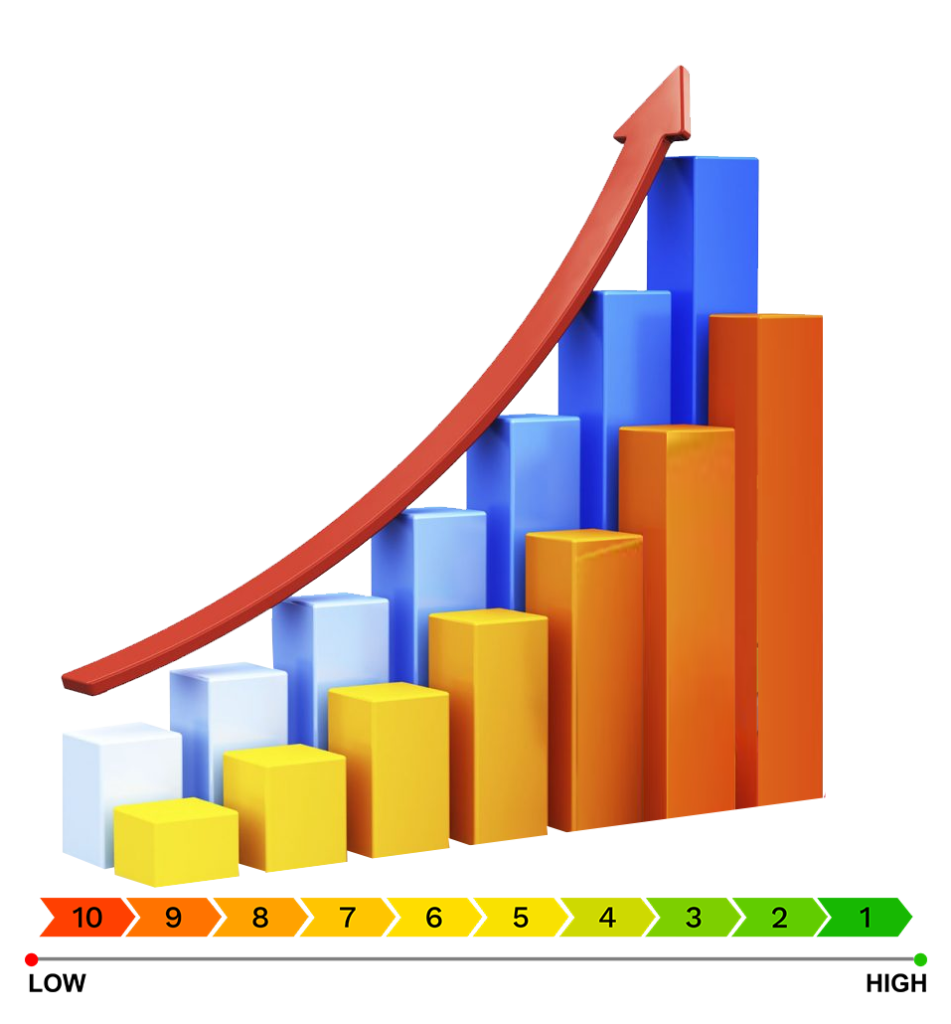

A good Credit Rank is a key step to better finance.

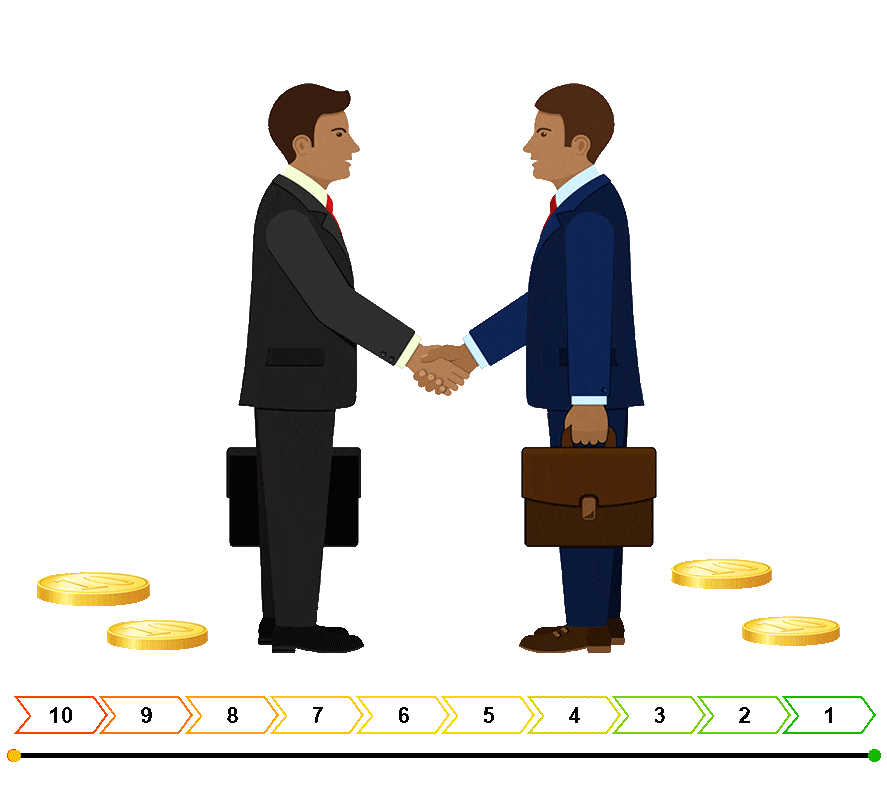

Every business need financial assistance and support. Business loans are the best way to ensure seamless functioning of business. Businesses seeking loan exposure of 10 lakh to 50 crores needs to have a good CIBIL Rank. Get professional assistance on commercial credit report analysis and keep a tab on your creditworthiness with Credit Help India.

Credit Help India assists you with:

We are a dedicated credit report assistance service provider. Our expert team is proficient to analyse, assess and work on improving the credit reports.

We understand that a poor credit rating can have a negative impact on your credit report. Hence, we have created a team of credit report analysts who study the report and immediately take actionable measures that can improve your credit ranking.

Limit the probability of any default or error, or flaws in your credit report with our flawless credit report services.

Before making a choice, consider your financial responsibilities.

You can look up a significant business borrower's credit history.

Risks are reduced, and you can borrow with assurance.

You can learn more about the total borrowings across different lending institutions.

Faster credit disbursement is possible.

OTP and Register

Verify your mobile number and register with us in seconds.Check Your Eligibility

Tell us about yourself, your business and what you need your loan for.Upload Your Documents

Upload your personal and business KYC documents, bank statements and other supporting documents to get your loan.Enter the mobile number that you use with your bank or loan accounts.

Verify it via a One Time Password (OTP) and give consent to our terms of service and privacy policy.

We also ask you to allow us to initiate a soft pull of your credit report on your behalf. The soft pull does NOT count as an enquiry on your bureau profile and, in fact, you get a copy of your credit report delivered to your email!

Fill out your basic details. You will need to provide your Permanent Account Number (PAN), so keep it handy if you don't remember it!

Tell us about your business and your financing needs and get an answer. This will only take 2 minutes.

If you are not eligible, get to know why. Zero Risk to your credit score.

Depending on the type and size of the loan you are looking for, we will explain which additional supporting documents you need to upload to complete your application.

If you can't upload all your documents right away, don't worry. You can always log in later and upload the remaining required documents.

Enter the mobile number that you use with your bank or loan accounts.

Verify it via a One Time Password (OTP) and give consent to our terms of service and privacy policy.

We also ask you to allow us to initiate a soft pull of your credit report on your behalf. The soft pull does NOT count as an enquiry on your bureau profile and, in fact, you get a copy of your credit report delivered to your email!

Fill out your basic details. You will need to provide your Permanent Account Number (PAN), so keep it handy if you don't remember it!

Tell us about your business and your financing needs and get an answer. This will only take 2 minutes.

If you are not eligible, get to know why. Zero Risk to your credit score.

Depending on the type and size of the loan you are looking for, we will explain which additional supporting documents you need to upload to complete your application.

If you can't upload all your documents right away, don't worry. You can always log in later and upload the remaining required documents.

Personal KYC

Business KYC

Bank Statements/Financials

Residential Address Proof

Really thankful to the team of credit help India for resolving our long pending issues. Earlier due to incorrect information registered regarding our 28 loan accounts our CMR rating was 9 and now according to latest CCR it has been improved to 3 ranking. Here we wish to mention that the team of Credit Help India Services Pvt. Ltd are very professionally sound and they have managed our CIBIL account very efficiently that within 4 months.

My CIBIL report was in very bad condition having rank 8, I talked with Credit Help India for improvement for the rank, They done a very good job to help me out. Now my rank is 4 and I m very happy with their working. Thank you Credit Help India.

Availing services from Credit Help India Services Pvt Ltd helped me a lot to improve my firm CMR rating. Timely follow up was taken by the team of Credit Help India Services from the concerned institutions and timely updates were shared with me via calls and emails. So overall great working . Thank you to the entire team of Credit Help Services Pvt Ltd. The team is committed and concerned to improve our rating.

There are many credit myths in the financial world. Here are a few around CIBIL Score

You can download the report from the Company Credit Report (Commercial) portal of CIBIL by submitting some details and paying the requisite fee.

Members of CIBIL, including Banks, NBFCs and Financial Institutions can access Company Credit Report and CIBIL Rank.

An individual is assigned CIBIL Score which ranges from 300-900 while CIBIL Rank which ranges between 1 to 10 is given to commercial entities. A CIBIL Score that is close to 900 is considered good while any CIBIL Rank which is close to 1 is considered good.

When NA is being shown on Commercial CIBIL that means either the company have not taken any loan in the past or the amount of loan which a company have taken is either outstanding loan amount is not between Rs 10 Lakh and Rs 50 Crore.

There could be capturing of some information which is correct but displaying in your company commercial credit report. You should raise a dispute to rectify the incorrect information in such a case t the moment you observe such errors raise the dispute with CIBIL. Any wrong information can spoil your CIBIL Commercial report and CIBIL Rank